|

Nepal Stock Market Update; Growth of top 10 Companies.

|

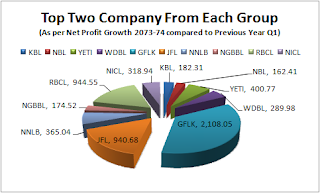

Based on percentage change, six

banks have managed to increase their profit by more than 100%. The net profit

of Kumari Bank has risen by 182.31%, which is highest among the Commercial

Banks. Nepal Bank limited has managed to increase its net profit in amount and

percentage as well.

In terms of percentage, change in

the net profit of Development Banks, Yeti Development Bank has shown tremendous

growth of 400.77%.

According to the analysis, Naya

Nepal Laghubitta's net profit grew massively by 365.04%. In the corresponding

quarter last fiscal year, the company was at a loss of Rs 4.52 lakh.

Here is the list of top 10

Companies of different sectors as per their net growth percentage.

Table 1: Nepal Stock Market Update;

Growth of top 10 Companies.

|

S.N

|

Banks

|

Paid Up

Capital (Q1) |

Reserve &

Surplus |

Net '000'

Profit (Q1) |

Increase

|

EPS

|

||

|

Name

|

Rs in '000'

|

Rs in '000'

|

This

Quarter |

Corresponding Previous Q1

|

%

|

Annualized

|

||

|

1

|

Kumari Bank

|

2,699,167.00

|

1,501,686.00

|

137,436.00

|

48,682.00

|

182.31

|

31.49

|

|

|

2

|

Nepal Bank

|

6,499,478.00

|

1,534,512.00

|

1,166,084.00

|

444,366.00

|

162.41

|

71.76

|

|

|

3

|

NMB Bank

|

5,430,062.00

|

2,445,788.00

|

353,685.00

|

142,855.00

|

147.58

|

31.46

|

|

|

4

|

Citizen Bank

|

5,537,352.00

|

1,648,217.00

|

345,157.00

|

142,780.00

|

141.74

|

24.93

|

|

|

5

|

Sunrise Bank

|

5,301,396.00

|

1,096,387.00

|

253,116.00

|

117,802.00

|

114.86

|

19.10

|

|

|

6

|

Siddhartha Bank

|

3,375,119.00

|

3,589,818.00

|

359,676.00

|

172,036.00

|

109.07

|

47.61

|

|

|

7

|

Everest Bank

|

2,742,604.00

|

6,383,001.00

|

513,421.00

|

263,703.00

|

94.69

|

77.13

|

|

|

8

|

Nepal Bangladesh B

|

4,011,759.00

|

2,252,594.00

|

225,019.00

|

124,892.00

|

80.17

|

22.00

|

|

|

9

|

NIB

|

8,706,612.00

|

8,321,939.00

|

740,800.00

|

423,834.00

|

74.78

|

34.03

|

|

|

10

|

Mega Bank

|

3,240,575.00

|

2,609,600.00

|

146,947.00

|

84,348.00

|

74.21

|

17.80

|

|

|

|

Dev. Bank

|

|

|

|

|

|

|

|

|

1

|

Yeti Dev Bank

|

1,386,233.00

|

115,216.00

|

66,228.00

|

13,225.00

|

400.77

|

19.11

|

|

|

2

|

Western Dev Bank

|

156,960.00

|

67,656.14

|

2,958.38

|

758.59

|

289.98

|

7.53

|

|

|

3

|

Bhargav Bikas

|

120,000.00

|

49,291.00

|

6,581.65

|

1,977.30

|

232.86

|

21.93

|

|

|

4

|

Saptakosi Dev Bank

|

100,000.00

|

6,325.00

|

695.00

|

(543.00)

|

227.99

|

0.69

|

|

|

5

|

Sajha Bikas Bank

|

100,000.00

|

(24,961.49)

|

5,037.65

|

(4,862.30)

|

203.60

|

5.04

|

|

|

6

|

Mission Dev Bank

|

194,999.00

|

86,000.00

|

17,300.00

|

6,651.00

|

161.11

|

8.91

|

|

|

7

|

Jyoti Bikas Bank

|

987,026.00

|

307,208.00

|

43,576.00

|

16,954.00

|

157.02

|

17.66

|

|

|

8

|

Kailash Bikas

|

1,580,336.00

|

994,368.00

|

130,198.00

|

51,931.00

|

150.71

|

32.96

|

|

|

9

|

Sahayogi Bikas Bank

|

257,877.00

|

150,317.00

|

15,517.00

|

6,517.00

|

138.10

|

24.07

|

|

|

10

|

Araniko Dev Bank

|

257,800.00

|

138,800.00

|

8,172.00

|

3,597.00

|

127.18

|

12.68

|

|

|

|

Finance

|

|

|

|

|

|

|

|

|

1

|

Gorkhas Finance

|

578,662.00

|

275,198.00

|

63,570.00

|

2,879.00

|

2,108.05

|

43.92

|

|

|

2

|

Janaki Finance

|

310,781.00

|

245,299.14

|

17,542.57

|

1,685.68

|

940.68

|

5.64

|

|

|

3

|

Sagarmatha Finance

|

369,298.70

|

230,567.77

|

32,762.94

|

3,493.30

|

837.87

|

35.49

|

|

|

4

|

211,673.31

|

163,834.24

|

14,715.51

|

3,487.46

|

321.95

|

27.80

|

||

|

5

|

ICFC Finance

|

800,000.00

|

343,412.00

|

66,125.00

|

17,800.00

|

271.48

|

38.60

|

|

|

6

|

Central Finance

|

246,757.00

|

157,953.00

|

2,992.00

|

(3,910.00)

|

176.52

|

1.21

|

|

|

7

|

United Finance

|

643,800.00

|

176,884.00

|

10,220.00

|

3,963.00

|

157.88

|

6.35

|

|

|

8

|

Pokhara Finance

|

491,100.00

|

210,300.00

|

16,400.00

|

7,503.00

|

119.55

|

13.41

|

|

|

9

|

Union Finance

|

176,585.00

|

(60,576.00)

|

3,982.00

|

(29,057.00)

|

113.70

|

2.25

|

|

|

10

|

Hama Merchant

|

221,000.00

|

200,000.00

|

3,448.00

|

1,680.00

|

105.23

|

6.24

|

|

|

|

Microfinance

|

|

|

|

|

|

|

|

|

1

|

Naya Nepal Micro

|

20,000.00

|

12,752.00

|

1,198.00

|

(452.00)

|

365.04

|

23.96

|

|

|

2

|

Nepal Grameen Bikas

|

557,500.00

|

45,885.00

|

30,126.00

|

10,974.00

|

174.52

|

21.62

|

|

|

3

|

Laxmi Microfinance

|

110,000.00

|

95,756.00

|

24,873.00

|

10,330.00

|

140.78

|

90.54

|

|

|

4

|

Suryodaya Laghubitta

|

28,000.00

|

24,056.00

|

6,682.56

|

2,974.74

|

124.64

|

|

|

|

5

|

National Microfinance

|

100,000.00

|

66,524.00

|

18,391.00

|

8,330.00

|

120.78

|

73.56

|

|

|

6

|

NMB Microfinance

|

86,300.00

|

31,000.00

|

9,485.00

|

4,587.00

|

106.78

|

43.94

|

|

|

7

|

Nirdhan Utthan

|

600,000.00

|

655,165.00

|

157,080.00

|

79,967.00

|

96.43

|

41.89

|

|

|

8

|

Vijaya Laghubitta

|

140,000.00

|

38,007.14

|

7,537.18

|

4,186.80

|

80.02

|

21.52

|

|

|

9

|

Nerude Laghubitta

|

180,000.00

|

221,053.04

|

14,195.00

|

8,131.00

|

74.57

|

31.54

|

|

|

10

|

Sana Kisan Bikas

|

402,449.88

|

995,184.84

|

79,137.76

|

48,862.17

|

61.96

|

78.66

|

|

|

|

Non Life Insurance

|

|

|

|

|

|

|

|

|

1

|

RBCL

|

124,440.00

|

1,936,232.00

|

234,733.00

|

22,472.00

|

944.55

|

188.63

|

|

|

2

|

NICL

|

287,608.00

|

142,104.00

|

24,965.00

|

5,959.00

|

318.94

|

7.61

|

|

|

3

|

United Insurance

|

252,000.00

|

205,208.00

|

16,555.03

|

5,180.00

|

219.59

|

26.27

|

|

|

4

|

Sagarmatha Ins

|

441,223.00

|

356,544.00

|

30,936.00

|

10,491.00

|

194.88

|

7.01

|

|

|

5

|

Neco Insurance

|

324,043.00

|

123,489.00

|

25,082.00

|

9,846.00

|

154.74

|

30.96

|

|

|

6

|

Shikhar Insurance

|

509,897.30

|

464,467.01

|

87,018.24

|

42,338.61

|

105.52

|

68.26

|

|

|

7

|

Lumbini General Ins

|

330,000.00

|

115,240.00

|

38,867.00

|

20,844.00

|

86.46

|

47.11

|

|

|

8

|

Himalayan General

|

321,000.00

|

139,583.00

|

19,794.00

|

12,012.00

|

64.78

|

6.17

|

|

|

9

|

Premier Insurance

|

373,753.00

|

287,502.00

|

20,440.00

|

13,559.00

|

50.74

|

19.83

|

|

|

10

|

Siddhartha Insurance

|

344,850.00

|

165,078.00

|

38,025.00

|

28,755.16

|

32.23

|

11.03

|

|

These market updates helps to know about market's performance in a better manner. For framing a better trading strategy learning about market updates timely is must. Financial Advisory Services like stock tips and other trading tips can help in earning desired returns.

ReplyDelete