|

| Nepal Stock Market Update; EPS analysis |

Quarterly reports are often an important time for publicly traded companies because the earnings report may significantly affect the value of a company's stock. Stock value may increase or decrease according to the companies' good or poor quarter report. Stock prices fluctuate wildly everywhere on any stock market when the quarterly earnings report is released.

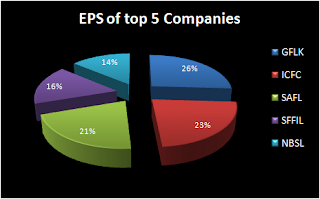

As per the unaudited

financial reports of the first quarter published by 22 Finance companies, EPS of Gorkha Finance Company is 43.92, ICFC

Finance Company is 38.48 and Sagarmatha Finance Company is 35.49 respectively.

Table 1: Nepal Stock Market Update; EPS analysis

S.N

|

Name

|

Paid Up

Capital (Q1) |

Reserve &

Surplus |

Net '000'

Profit (Q1) |

Increase

|

EPS

|

Net

Worth |

NPL

|

||

Finance

|

Rs in '000'

|

Rs in '000'

|

This

Quarter |

Corresponding Previous Q1

|

%

|

Annualized

|

Rs

|

%

|

||

1

|

International Leasing

|

2,008,800.00

|

230,979.57

|

(52,790.94)

|

442,089.00

|

(111.94)

|

17.56

|

|||

2

|

ICFC Finance

|

800,000.00

|

343,412.00

|

66,125.00

|

17,800.00

|

271.48

|

38.60

|

150.11

|

1.60

|

|

3

|

United Finance

|

643,800.00

|

176,884.00

|

10,220.00

|

3,963.00

|

157.88

|

6.35

|

127.47

|

0.99

|

|

4

|

Gorkhas Finance

|

578,662.00

|

275,198.00

|

63,570.00

|

2,879.00

|

2,108.05

|

43.92

|

147.70

|

10.56

|

|

5

|

Pokhara Finance

|

491,100.00

|

210,300.00

|

16,400.00

|

7,503.00

|

119.55

|

13.41

|

142.84

|

2.16

|

|

6

|

Synergy Finance

|

474,409.00

|

(213,831.00)

|

5,329.00

|

5,502.00

|

(3.14)

|

1.12

|

20.00

|

23.51

|

|

7

|

Goodwill Finance

|

453,750.00

|

330,000.00

|

11,960.42

|

8,050.21

|

48.57

|

10.54

|

123.97

|

1.98

|

|

8

|

Lumbini Finance

|

412,500.00

|

477,599.59

|

6,142.27

|

4,045.49

|

51.83

|

1.48

|

215.78

|

7.61

|

|

9

|

Sagarmatha Finance

|

369,298.70

|

230,567.77

|

32,762.94

|

3,493.30

|

837.87

|

35.49

|

162.43

|

4.53

|

|

10

|

Janaki Finance

|

310,781.00

|

245,299.14

|

17,542.57

|

1,685.68

|

940.68

|

5.64

|

178.92

|

2.69

|

|

11

|

Guheshori M. Banking

|

293,739.00

|

144,608.00

|

14,203.00

|

10,614.00

|

33.81

|

19.34

|

149.23

|

0.52

|

|

12

|

Jebil's Finance

|

256,850.00

|

68,773.00

|

3,978.00

|

2,873.00

|

38.46

|

1.55

|

126.78

|

7.05

|

|

13

|

250,600.00

|

128,300.00

|

9,084.00

|

9,086.00

|

(0.02)

|

14.48

|

151.21

|

3.33

|

||

14

|

Central Finance

|

246,757.00

|

157,953.00

|

2,992.00

|

(3,910.00)

|

176.52

|

1.21

|

150.11

|

1.14

|

|

15

|

Hama Merchant

|

221,000.00

|

200,000.00

|

3,448.00

|

1,680.00

|

105.23

|

6.24

|

133.17

|

1.15

|

|

16

|

211,673.31

|

163,834.24

|

14,715.51

|

3,487.46

|

321.95

|

27.80

|

177.39

|

1.18

|

||

17

|

Bhaktapur Finance

|

211,000.00

|

16,778.79

|

2,359.09

|

2,615.59

|

(9.80)

|

5.46

|

|||

18

|

Union Finance

|

176,585.00

|

(60,576.00)

|

3,982.00

|

(29,057.00)

|

113.70

|

2.25

|

43.82

|

17.64

|

|

19

|

Everest Finance Ltd

|

157,459.80

|

22,951.86

|

(2,381.93)

|

1,372.68

|

(273.52)

|

114.58

|

0.84

|

||

20

|

Arun Finance

|

150,000.00

|

(123,875.00)

|

(1,041.00)

|

(4,414.00)

|

76.41

|

(0.69)

|

17.42

|

97.90

|

|

21

|

Namaste Bittiya

|

46,500.00

|

11,132.51

|

2,728.77

|

2,505.54

|

8.90

|

23.47

|

123.94

|

0.91

|

|

22

|

Multipurpose Finance

|

37,030.00

|

32,200.00

|

950.80

|

829.30

|

14.65

|

6.97

|

|||

Learning about a company's performance helps in analyzing about its stocks performance. Further experts can be contacted for stock tips of highly accurate nature.

ReplyDelete