|

| Net Profit and EPS analysis; Nepal Stock Market Update. |

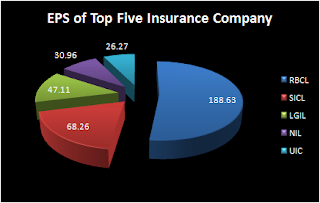

Most of the non-life and some

life Insurance companies have published their first quarter report (Q1) for the

fiscal year 2073-74. Among the report published by the insurance companies,

Rastriya Beema Company and Shikhar Insurance Company Limited has shown

impressive result in terms of net profit as well as earning per share (EPS).

The first quarter reports of the Insurance Companies are as follows.

Table 1: Net Profit and EPS analysis;

Nepal Stock Market Update.

|

S.N

|

Insurance

|

Paid Up

Capital (Q1) |

Reserve &

Surplus |

Net '000'

Profit (Q1) |

Increase

|

EPS

|

Net

Worth |

||

|

Name

|

Rs in '000'

|

Rs in '000'

|

This

Quarter |

Corresponding Previous Q1

|

%

|

Annualized

|

Rs

|

||

|

1

|

RBCL

|

124,440.00

|

1,936,232.00

|

234,733.00

|

22,472.00

|

944.55

|

188.63

|

2,520.40

|

|

|

2

|

Shikhar Insurance

|

509,897.30

|

464,467.01

|

87,018.24

|

42,338.61

|

105.52

|

68.26

|

296.24

|

|

|

3

|

Lumbini General Ins

|

330,000.00

|

115,240.00

|

38,867.00

|

20,844.00

|

86.46

|

47.11

|

218.48

|

|

|

4

|

Neco Insurance

|

324,043.00

|

123,489.00

|

25,082.00

|

9,846.00

|

154.74

|

30.96

|

197.56

|

|

|

5

|

United Insurance

|

252,000.00

|

205,208.00

|

16,555.03

|

5,180.00

|

219.59

|

26.27

|

243.66

|

|

|

6

|

Prudential Insurance

|

356,400.00

|

183,825.00

|

18,125.00

|

15,136.00

|

19.74

|

20.34

|

219.90

|

|

|

7

|

NLICL

|

1,019,125.90

|

580,688.01

|

50,559.14

|

35,501.62

|

42.41

|

19.84

|

164.44

|

|

|

8

|

Premier Insurance

|

373,753.00

|

287,502.00

|

20,440.00

|

13,559.00

|

50.74

|

19.83

|

204.77

|

|

|

9

|

Prime Life Insurance

|

488,160.00

|

714,811.00

|

22,726.00

|

26,447.00

|

(14.06)

|

18.62

|

246.43

|

|

|

10

|

NB Insurance

|

265,656.00

|

48,233.00

|

12,068.00

|

10,673.00

|

13.07

|

18.17

|

82.52

|

|

|

11

|

Siddhartha Insurance

|

344,850.00

|

165,078.00

|

38,025.00

|

28,755.16

|

32.23

|

11.03

|

254.03

|

|

|

12

|

Surya Life Insurance

|

500,000.00

|

202,740.00

|

12,355.00

|

7,701.00

|

60.43

|

9.88

|

144.16

|

|

|

13

|

Asian Life Ins

|

671,327.70

|

231,098.26

|

14,502.62

|

11,000.08

|

31.84

|

8.64

|

134.42

|

|

|

14

|

NICL

|

287,608.00

|

142,104.00

|

24,965.00

|

5,959.00

|

318.94

|

7.61

|

170.51

|

|

|

15

|

Sagarmatha Ins

|

441,223.00

|

356,544.00

|

30,936.00

|

10,491.00

|

194.88

|

7.01

|

238.91

|

|

|

16

|

Gurans Life Ins

|

550,000.00

|

171,633.46

|

8,926.77

|

5,423.71

|

64.58

|

6.49

|

131.21

|

|

|

17

|

Himalayan General

|

321,000.00

|

139,583.00

|

19,794.00

|

12,012.00

|

64.78

|

6.17

|

229.20

|

|

|

18

|

Prabhu Insurance

|

329,073.00

|

110,400.00

|

19,924.00

|

15,545.00

|

28.16

|

6.00

|

212.00

|

|

|

19

|

Everest Insurance

|

101,250.00

|

121,396.00

|

1,051.00

|

1,512.00

|

(30.48)

|

1.04

|

318.09

|

|

|

20

|

LICN

|

1,069,453.12

|

855,562.50

|

8,580.90

|

16,549.50

|

(48.15)

|

0.80

|

117.54

|

|

|

21

|

Oriental Insurance

|

|

(181,995.92)

|

6,318.38

|

7,746.92

|

(18.44)

|

|

|

|

Useful information on insurance sector I gained here. Traders who trade in commodities can easily improve their returns by consulting experts for their suggestions on commodity tips .

ReplyDelete